(Reuters) – The U.S. government-run mortgage finance firms Fannie Mae and Freddie Mac could play a bigger role in turning around the battered U.S. housing market, the Federal Reserve told Congress, a call that looks set to run into stiff political opposition.

The Fed, in a paper sent to lawmakers on Wednesday, outlined an array of steps that could be taken to help the housing sector, including allowing Fannie and Freddie to provide cheaper mortgages to a broader pool of homeowners.

The two companies, the biggest sources of U.S. mortgage funding, were seized by the government in 2008 when they were on the brink of collapse. They have been propped up by $169 billion in taxpayer aid since then, making them a target of many on Capitol Hill.

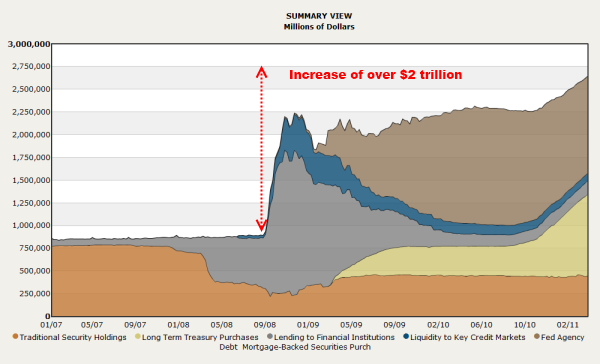

Here’s a view of the Fed’s balance sheet composition from April 2011; it hasn’t materially changed much since then (other than going up still further), and you’ll get the idea from the picture:

The big, brown blob on the upper right side of the chart represents the Fed’s holdings of…mortgages. As you can see from the chart, prior to the crisis, the Fed’s mortgage holdings amounted to…zero. So you can understand why the Fed is anxious to get rid of this toxic sludge component of its “investments.”

But, what to do with them? The only reason they’re worth anything at all in a collapsing economy is because the Fed has supported them by buying them, an intervention which at the time encouraged other institutions to buy them as well. As soon as the Fed starts selling them so will everyone else; the intervention unwinds, as it must. There has been no genuine improvement in the wealth-creating ability of our economy, there have only been a huge spate of interventions to delay reality. The can has been kicked down the road, in other words.

Enter you, dear reader! You have bottomless pits of money or at least bottomless pits of labor we can steal from you, you are quite accustomed to playing “white knight” to the banks’ damsel in distress! You didn’t have anything special you wanted to do with your time, labor, and money, did you? Well, give it to the banks!

You see, when the Fed says it thinks Fannie and Freddie can pony up and support the real estate market, what they’re really saying is that it’s time for you, the taxpayer, to support the housing market so that the Fed can unload its toxic sludge, and maybe the big banks on Wall Street can frontrun the trade and make a profit! You get to take the losses! Fannie and Freddie already hold about $5 Trillion in mortgages, what’s another $Trillion or so? Woo Hoo!