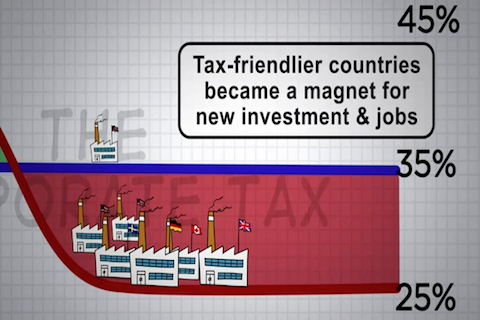

From the The Tax Foundation:

Corporate Taxes: Falling Behind by Standing Still

The United States has been slipping from a position of economic competitiveness in recent years, in part because of changing corporate tax rates across the globe. Once a leader internationally, waves of tax reform in dozens of countries have left the U.S. burdened with one of the highest corporate tax rates in the world, slowing new investment and job growth. Produced by the Tax Foundation in Washington, D.C.