Federal Reserve Chairman Ben S. Bernanke signaled he’s concerned Europe’s crisis will hobble a 2 1/2-year U.S. expansion that may need another boost from the central bank.

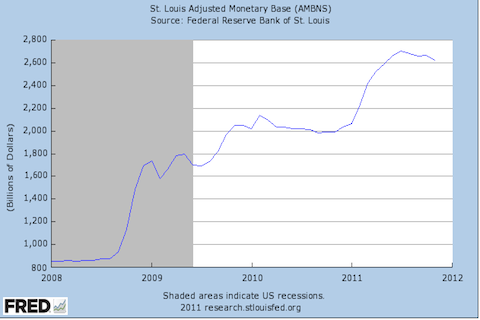

The economy allegedly “grew” at about 2% this fiscal year. In the meantime, the federal government borrowed and spent the equivalent of 13% of GDP. SO if we take out the deficit-spending, real economic activity shrank at an 11% annual rate. In calendar year 2011, the Fed has created a little over $500 Billion and lent it into the economy. That number alone is about 3.5% of GDP. Bernanke is printing the “expansion.” The money is being stolen from savers.

Why do we put up with this? Economies run on confidence, not con-games.