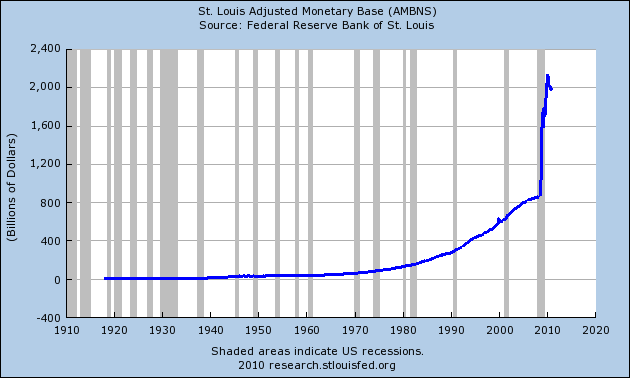

1. The Ben Bernank prints up an insane amount of money and floods the world with it:

2. Food prices start to rise (this is wheat):

3. The man on the street in North Africa starts to starve, protests begin, and governments start to fall:

http://www.benzinga.com/11/01/782891/food-riots-2011

- The stunningly violent food riots in Tunisia and Algeria show just how quickly things can change. Just a few months ago, these two northern Africa nations were considered to be very stable, very peaceful and without any major problems. But now protesters are openly squaring off with police in the streets.

(Don’t be fooled by the popular press. This is economic frustration boiling over, fueled by hunger.)

4. The House of Saud, finding itself in serious trouble, tries to bribe the Saudi people with free stuff:

- The king of Saudi Arabia last night announced $36bn (£22bn) of extra benefits for his people in an attempt to stop the wave of Arab uprisings spreading to the world’s biggest oil exporter, as experts warned Brent crude could hit $220 a barrel.

- King Abdullah’s support package offers to give 18m lower and middle-income Saudi’s inflation-busting pay rises, unemployment benefits and affordable housing. The cash-rich Saudi government pledged to spend a total of $400bn by the end of 2014 to improve education, health care and the kingdom’s infrastructure.

5. Meanwhile, the Saudis send tanks to Bahrain to help quell unrest there:

http://www.veteranstoday.com/2011/02/28/bahrain-exclusive-breaking-news-saudi-tanks-arrive/

- Bahrain–Eyewitnesses have reported seeing an estimated 30 tanks being transported into Bahrain from Saudi Arabia on Monday night at around 6:45pm local time. The tanks were sighted along the King Fahd causeway, which links the small island-nation of Bahrain to Saudi Arabia.

6. Finding ltself in need of more money for bribes and tanks, the Saudis indicate their willingness to let the price of oil rise to $120.00 per barrel (it’s at $96 now…):

http://moneywatch.bnet.com/investing/blog/against-grain/opec-sources-saudi-arabia-worried-about-strife-will-let-oil-rise-to-120/943/?tag=col1;fd-banner-news

- Saudi Arabia won’t take significant steps to bring down the price of crude oil until Brent, the grade traded most on the open market, reaches $120 a barrel, about 8 percent above current levels. That’s the conclusion of an internal report prepared by a major investment firm based on information from its extensive and knowledgeable contacts within OPEC.

Cause and effect are simple to understand, aren’t they? We must stop the madman at the Federal Reserve.