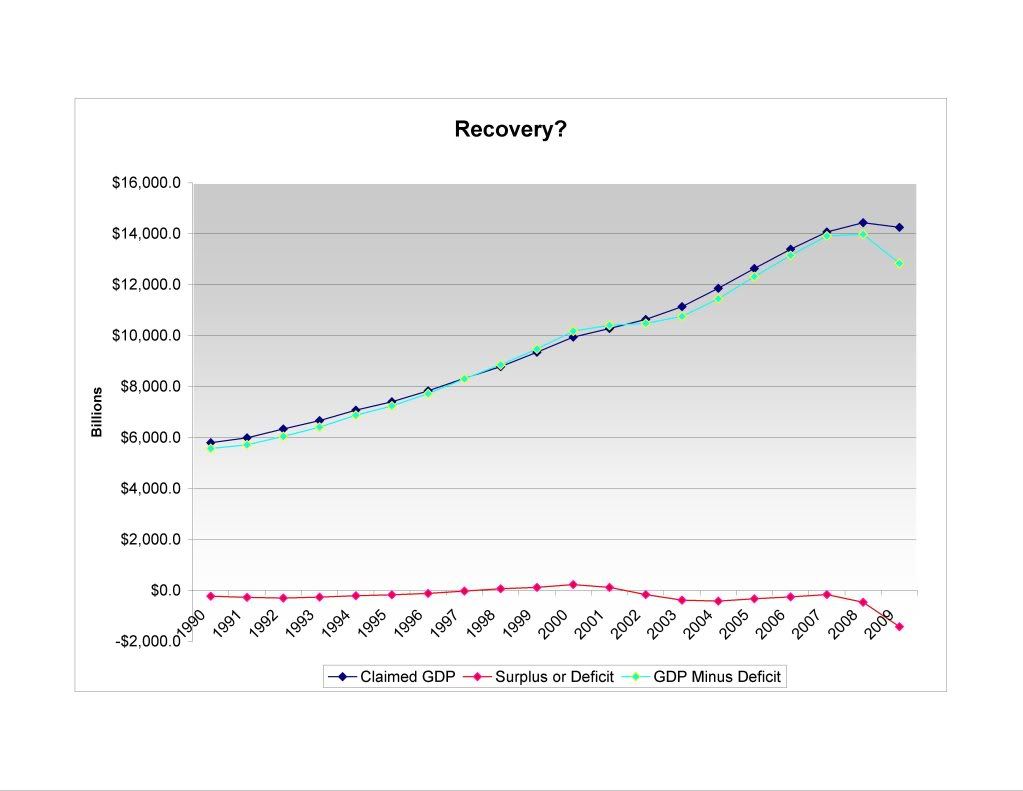

(Data sources are US CBO and Federal Reserve)

The chart above (click, then click again to enlarge) shows three data sets: 1) in red, the federal budget deficit; 2) in dark blue, US Gross Domestic Product (GDP), the supposed size of the US economy; 3) in highlighted light blue, shows what US GDP would be if it were not for the added government deficit spending. It is plain to see the $1.5 trillion federal deficit in 2009 caused US GDP to appear to fall only slightly. But let’s do some math: If US GDP was $14.3 trillion in 2009, and the deficit was $1.5 trillion for that year, then deficit spending was 1.5/14.3 = 10.5% of GDP. Got it?

OK, now let’s do some more math. According to published numbers, the US GDP shrank by about 1.3% from 2008 to 2009. But as we just saw above, deficit spending added 10.5% to GDP last year. Which means, roughly, that US GDP actually shrank last year by more than 10%. Which means of course that the “recovery” is a mirage, a ghost, a “talking point,” a feel-good, bald-faced lie.

Is this “recovery” sustainable? Sure, if you believe that we can continue to borrow and spend 10% more than we produce. Or, perhaps the recovery is sustainable if economic activity is really picking up on its own. Let’s take a look at who is “recovering” and who is not.

As Robert Lenzner points out Six Giant Banks Made $51 Billion Last Year; The Other 980 Lost Money:

An oligopoly of Goldman, BofA, JPMorgan, Morgan Stanley, Citi and Wells Fargo is flourishing.

Focus hard on this shocking Wall Street reality: The top six bank holding companies earned an aggregate of $51 billion in pretax income in 2009. We’re talking about JPMorgan Chase, Goldman Sachs, Bank of America, Morgan Stanley, Citigroup and Wells Fargo.

All of this pretax income can be attributed to their trading revenues of $59.7 billion. The proprietary trading operations of an oligopoly of banks, saved from disaster by Uncle Sam’s largesse and subsidized with cheap money from the central bank, was the single driving force behind the restoration of their fortunes and the renewed surge in their stock prices.

So yeah! The big banks are doing GREAT, thank you very much! Woo hooo!! How about the serfs in middle America?

Well, Bloomberg reports that Bernanke Says Unemployment Unlikely to Fall Quickly:

Federal Reserve Chairman Ben S. Bernanke said the U.S. recovery probably won’t quickly bring down the unemployment rate, which is likely to stay “high for a while.”

Given the depth of the recession, the recovery is “moderate paced,” Bernanke said last night in a question-and-answer session with Sam Donaldson, the ABC News journalist, in Washington. In Europe, policy makers “are committed to avoiding default in Greece” and elsewhere, he said. […]

“The unemployment rate is still going to be high for a while, and that means that a lot of people are going to be under financial stress,” Bernanke said at the event, part of a dinner hosted by the Woodrow Wilson International Center for Scholars. (emphasis added)

So, are you guys feelin’ the love? I guess this “recovery” thing is all a matter of perspective, huh?

Austerity for the middle class, and endless free money and profits for the banks.

I guarantee it.