Or is it too late?

One of the few pleasures of being an “outsider” financial pundit is watching your “mainstream” brethren (finally) abandon their orthodoxies. I have always believed, and have said to anyone who would listen, that the reason we are in this mess is because there is a critical mass of “economic thinkers” who have the ears of our policymakers, who get together from time to time to breathe each others’ exhaust fumes, and who believe above all else in the government’s right to “manage” the economy. In other words, there is an orthodoxy, a paradigm if you will, that rules mainstream economic thought, and that will continue to do so right up until the monetary system explodes in our faces. Only a monetary breakdown can break that paradigm.

So it is with great interest I read this piece from Ambrose Evans-Pritchard in the UK Telegraph:

- I apologise to readers around the world for having defended the emergency stimulus policies of the US Federal Reserve, and for arguing like an imbecile naif that the Fed would not succumb to drug addiction, political abuse, and mad intoxicated debauchery, once it began taking its first shots of quantitative easing.

- So all those hillsmen in Idaho, with their Colt 45s and boxes of krugerrands, who sent furious emails to the Telegraph accusing me of defending a hyperinflating establishment cabal were right all along. The Fed is indeed out of control.

- The sophisticates at banking conferences in London, Frankfurt, and New York who apologized for this primitive monetary creationism – as I did – are the ones who lost the plot.

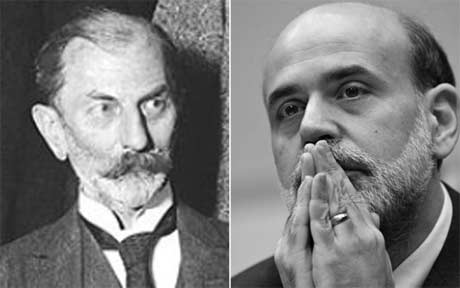

The linked article includes references to Mr. Evans-Pritchard’s creds, in case those are important to you. I want to personally thank Mr. Evans-Pritchard for placing Ben Bernanke’s picture alongside Rudolf von Havenstein, president of the Reichsbank during the Weimar hyperinflation. That image is shamelessly reproduced below for your viewing pleasure.