The PhD-waving geniuses at the Fed have glanced up from their mathematical models and analytical brilliance and (re)discovered an age-old economic phenomenon: Reversion to the mean. Prices for assets tend to return to “normal” patterns after bubbles and busts.

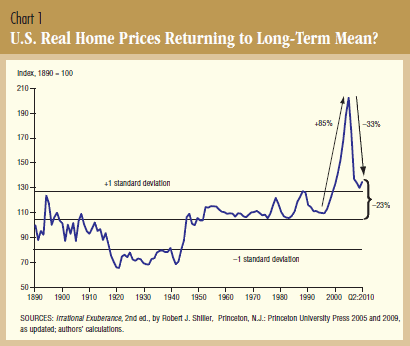

Housing prices in “real” (inflation adjusted) dollars since 1890:

in 2004, Greenspan said The Fed couldn’t tell if housing was in a bubble. So here’s a question for all uneducated bumpkins out here in the unwashed masses:

Can you spot the price bubble on the chart above? Could you have spotted it in August 2004 when Greenspan said he couldn’t? If you can, maybe you’re not so uneducated after all, and maybe you don’t need PhD-waving geniuses to run your economy.