Debt Limit Debate: What’s Really Going On?

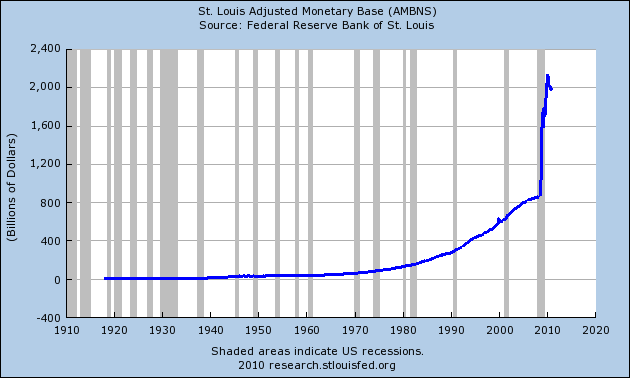

Watching TV while eating lunch today inspired this rant. Relevant ideas for your consideration: The budget "cuts" are compounded over ten years, but the debt ceiling raise is just until it gets used up again. So when they talk about "$2 Trillion in cuts and $2 Trillion in debt ceiling increase" what they mean is [...]